How to Choose the Right Loan App in India for Your Financial Needs

In today’s fast-paced world, financial emergencies don’t always come with a warning. Whether it’s a medical bill, a sudden business expense, or just making ends meet before payday, having access to quick funds can make a world of difference. That’s where loan apps have transformed the Indian lending landscape, offering instant access to credit without the hassle of traditional paperwork or lengthy bank approvals.

But while the market is flooded with options, not every app is created equal. Picking the best loan app for your needs is more than just clicking the first link on the search results. It requires a careful look at your financial goals, repayment capacity, and most importantly, the trustworthiness of the platform. This article will help you understand how to evaluate your options, what red flags to watch out for, and how to make smart borrowing choices.

Understanding the Rise of Loan Apps in India

In the last few years, the digital lending sector in India has seen a massive boom. Thanks to smartphone penetration, simplified KYC processes, and growing comfort with mobile financial services, more Indians are opting for loan apps over traditional lending routes. The appeal lies in their speed, accessibility, and ease of use. For many borrowers, especially freelancers, gig workers, or those without a formal credit history, these apps have opened doors that banks have long kept shut.

But with convenience comes risk. Not all apps follow RBI guidelines. Some charge exorbitant interest rates or come with hidden fees buried deep in the fine print. Others may misuse borrower data or engage in aggressive recovery tactics. That’s why doing your homework before downloading a lending app is absolutely essential.

Assessing Your Financial Needs First

Before jumping into comparisons, pause and reflect on why you need the loan in the first place. Is it for a short-term emergency? Are you looking to consolidate existing debt? Or is it a planned expense like funding a course, buying a gadget, or renovating your home?

Your loan purpose will dictate what kind of features to look for in an app—tenure flexibility, repayment options, interest rates, or even the loan amount range. For instance, if it’s a recurring need or you’re self-employed with fluctuating income, you might prefer an app that allows multiple small loans or top-ups with minimal documentation.

Having clarity on your requirement also helps you avoid overborrowing. It’s easy to take more than needed when the process feels as simple as ordering food online. But remember, every rupee borrowed comes with a cost.

What Makes an App the “Best” for You?

The term best loan app is subjective—it entirely depends on your situation. Here are some key factors to weigh in your decision:

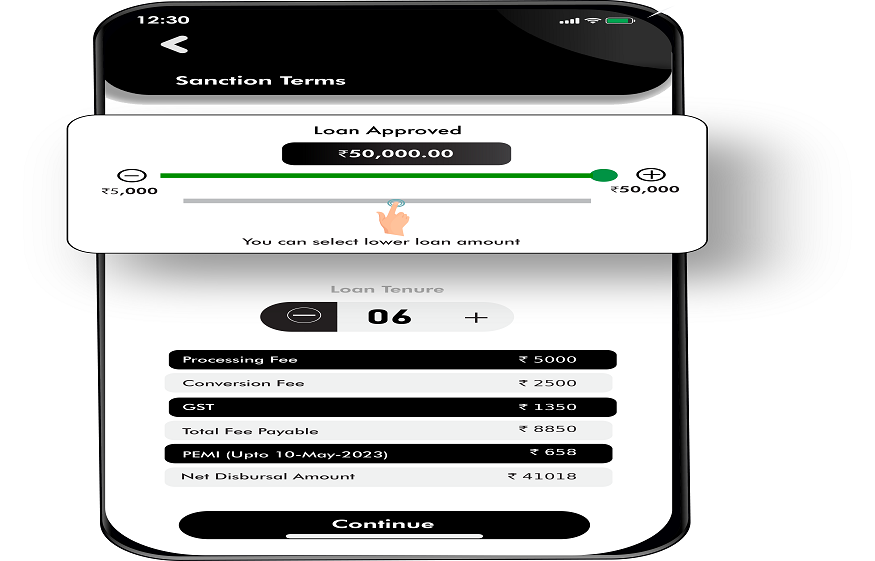

- Transparency in Charges

Always check the interest rate, processing fee, late payment charges, and prepayment conditions. The most trustworthy apps will show this upfront, not after you’re halfway through the application. Hidden charges are a red flag. - User Experience & Ease of Application

A clean, intuitive interface goes a long way. If the app’s process feels confusing or keeps throwing in new terms mid-way, it’s worth questioning their intentions. You should be able to upload documents, check eligibility, and understand terms without having to chase customer support. - Speed of Disbursement

When you’re applying for a loan, time is often of the essence. Look for apps that offer real-time approval and same-day disbursement. But don’t let speed be your only deciding factor—sometimes a slightly slower, more secure option is worth it. - Repayment Flexibility

Some apps allow you to customise your tenure or even make early payments without penalty. This kind of flexibility can save you money and ease repayment pressure, especially if your income is irregular. - Data Privacy and Compliance

This is often overlooked but should be non-negotiable. Check if the app mentions how it uses your data. Is it registered under an NBFC or partnered with a licensed financial institution? Apps not regulated under Indian laws should be avoided at all costs.

Look Beyond Ratings and Downloads

It’s tempting to equate high downloads with reliability, but that’s not always the case. Many apps may use paid reviews to inflate their ratings. Instead, dig deeper—read actual user feedback on social media forums or financial blogs. Watch for patterns. Are people complaining about repayment harassment? Is there confusion over terms?

Also, check the app’s update history. An app that hasn’t been updated in months may no longer comply with regulations or could have unresolved technical issues. Regular updates indicate that the app is actively maintained and adapting to user feedback or legal changes.

The Pitfalls of Ignoring Fine Print

Loan agreements—even digital ones—carry legal weight. Don’t skip through terms and conditions just to get to the “Apply Now” button. This is where critical information is often tucked away, including your consent to share data with third parties, penalties for late EMI, or even auto-debit mandates.

Make it a rule to screenshot or save a copy of your agreement, so you can refer to it later in case of disputes. If anything feels vague or inconsistent, don’t hesitate to drop the process altogether. Your financial health is too important to be taken lightly.

Know Your Rights as a Borrower

As a borrower in India, you have rights under RBI regulations—even when borrowing through loan apps. The lender must disclose all charges upfront, offer a grievance redressal mechanism, and treat borrowers with dignity during collections. If you feel you’ve been treated unfairly or are facing harassment, you can lodge a complaint with the app’s financial partner NBFC or directly with the RBI ombudsman.

This is also why it’s essential to verify that the app is associated with a registered lender. You can check this information on the RBI website. Never take a loan from an app that refuses to disclose its lending partner.

Building a Healthy Credit Profile Through Loan Apps

Interestingly, using the best loan app wisely can also help build your credit score. Timely repayments of small loans get recorded with credit bureaus, making it easier for you to qualify for larger loans in the future—be it a home loan, car loan, or business credit.

That said, misuse of these platforms—such as frequent borrowing, late payments, or loan stacking—can damage your creditworthiness. Treat app-based loans with the same discipline as you would a bank loan.

Final Thoughts: Choose Smart, Borrow Smarter

In the age of digital convenience, loan apps can be a boon when used with care. But selecting the best loan app is not just about speed or popularity—it’s about choosing one that aligns with your financial goals, respects your data, and empowers you to repay without stress.

Think of it this way: when you buy a new phone, you spend hours comparing features, reading reviews, and checking warranties. Shouldn’t you be just as careful when borrowing money?

Let your financial choices reflect your long-term thinking. After all, a loan might solve today’s problem—but choosing the right platform can protect tomorrow’s peace of mind.